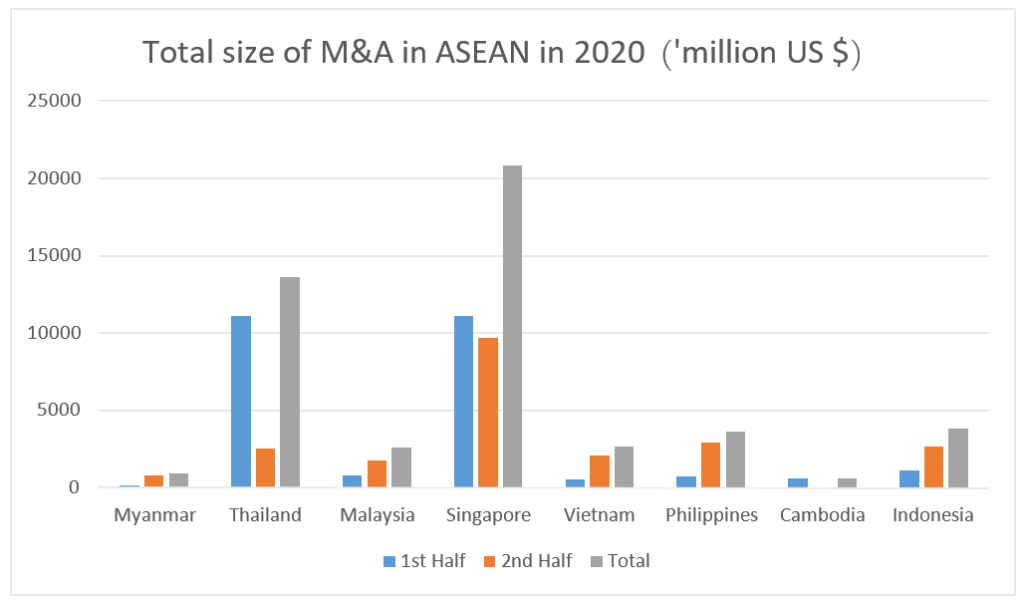

Singapore topped the list in both number of cases and monetary size. In terms of the number of cases, Singapore, Thailand, and Vietnam, which are said to have succeeded in containing the Covid19, increased the number of cases in the second half of the year compared to the first half, while Malaysia and Indonesia, which have not been able to halt the increase in the number of Covid-19 positive cases, saw a decrease in the number of M&A cases.

By industry, 71 cases (36 + 35) were in the real estate and infrastructure sector, 43 cases (22 + 21) in the manufacturing sector, 43 cases (21 + 22) in the telecom, media and technology sector, 39 cases (16 + 23) in the consumer goods sector, 18 cases (11 + 7) in the financial sector, 36 cases (9 + 27) in the energy sector, and we can see that real estate and infrastructure sector accounted for a quarter of the total (131 in the first half and 159 in the second half). Other sectors include health care, transportation and other services, and agricultural industries.

Thailand’s prominence in the first half of the year was due to the US$10.5 billion acquisition of Tesco’s Thai and Malaysian by CP Group. The restructuring of the CapitaLand Group in Singapore (US$8 billion) also contributed to the overall value. Next largest deals were the acquisition of Singaporean life insurance service provider Aviva Group (US$1.9 billion), followed by the investment by Philippines-based DITO CME Holdings in Udenna, a telecom company in the Philippines (US$1.4 billion), and UAE and Canadian investment firms’ investment in Singapore’s renewable energy company Equis (US$1.25 billion), and the U.S.-based Kimberly-Clark’s acquisition of Indonesian toiletry manufacturer Softex (US$1.2 billion). One of a large acquisition by a Japanese company was MUFG’s investment in Grab (US$ 0.7 billion). By major buyer country in the second half, there were 11 cases in the U.S., 10 cases in China, 6 cases in Japan, 5 cases in Canada, 5 cases in Germany, and 5 cases in the U.K.